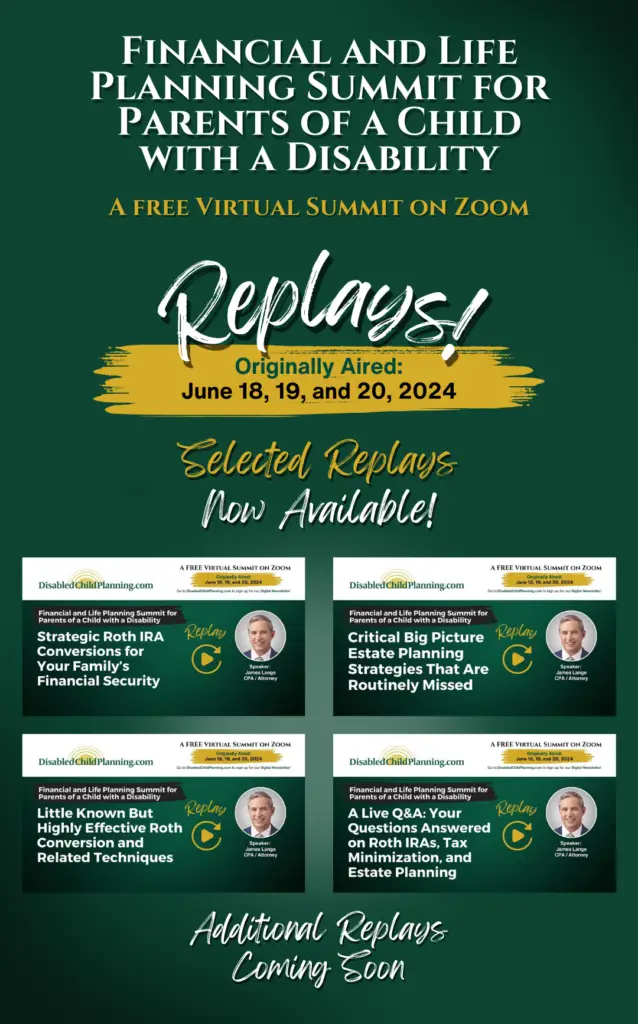

This summit was organized by James Lange and included an incredible array of speakers who shared their advice and recommendations drawn from their respective fields of expertise. All speakers work in areas that help parents of children with disabilities either directly or through adjacent services.

Featured speakers include the three co-authors of the best-selling book, Retire Secure for Parents of a Child with a Disability. All three authors and many reviewers believe this is the best financial book for parents of a child with a disability. Their advice, recommendations, and guidance will help you optimize a long-term financial plan to provide for your child’s life-long security. Other speakers focused on non-financial topics aimed at improving the family’s lifestyle, reducing anxiety and stress, and providing resources you can access.

- Expert Financial Guidance: Learn from the authors of the best-selling book Retire Secure for Parents of a Child with a Disability and discover proven strategies for securing your child’s financial future.

- Beyond Finances: Join our non-financial sessions to gain insights and practical tools for enhancing your family’s overall well-being, reducing anxiety, and creating a supportive environment.

- Access Valuable Resources: Discover a wealth of resources and tools to help you navigate the challenges and opportunities of raising a child with a disability.

- A Diverse Range of Experts: Hear from a variety of speakers who work directly with families of children with disabilities or provide adjacent services.

- Create a Custom Learning Experience: Choose from a variety of sessions to attend based on your individual needs and interests.

Get Your Copy Now!

Three Critical Steps to Protect Your Child’s Financial Security After You Are Gone

Just complete the form below to get this free valuable information.

Retire Secure For Parents of a Child with a Disability

Click here to read the latest DisabledChildPlanning.com Blog Post!

My co-authors and I believe you have discovered the best and most comprehensive financial resource available for parents of a child with a disability.

Our book explains, analyzes, and demonstrates how most parents can use very specific strategies to secure their financial life and the long-term financial life of their child.

This website offers supplemental information at no cost or obligation. You can download the Executive Summary and the Synopsis. Please see the links below.

A word to the wise. We highly recommend that you begin by reviewing the Table of Contents to quickly identify the information that is relevant and pertinent to your circumstances.

You can trust the content. This book has received glowing testimonials from prominent financial experts and the foreword was written by Burton G. Malkiel, Professor Emeritus of Economics, Princeton University, and author of the classic finance book, A Random Walk Down Wall Street. The authors’ credentials speak to their level of expertise (see below).

“Combining warmth and compassion with functional hard-headed advice, the dream team of Jim Lange, Deborah McFadden, and Julieanne E. Steinbacher have provided families of children with disabilities with the guidance they need to achieve financial security.”

―Burton G. Malkiel

Professor Emeritus of Economics, Princeton University and Author,

A Random Walk Down Wall Street (Over 2 Million Copies Sold)

What We Recommend

A brief outline of our three-step solution follows:

- Qualify for SSI or SSDI—the intricacies of which are expertly explained by Deborah McFadden, former U.S. Commissioner of Disabilities and mother of Tatyana McFadden, paralympic champion.

- Develop an appropriate estate plan that would protect government benefits but still provide benefits to the child with a disability for that child’s lifetime. Julie Steinbacher practices, writes, and teaches in this area.

- Establish a course of action for a long-term financial plan, which will likely involve Roth IRA conversions and ABLE accounts as well as many other techniques—my area of expertise and written for the lay reader.

For more specifics, especially on the third step, I highly recommend you scan the Table of Contents and read any section that interests you. Two little known areas that could potentially provide enormous value are Who Gets What (p. 335) and our plan to convert an Inherited Traditional retirement plan to a Roth after you die (p. 221).

About the Authors

Deborah L. McFadden is a Former United States Commissioner of Disabilities. She knows more about the intricacies of applying for SSI and SSDI than anyone I know of. Her contribution to the book could be life-changing for tens of thousands of readers. Furthermore, Deborah brings a wealth of personal expertise to the area. Her daughter, Tatyana McFadden, is one of the best known paralympic champions in the world with 20 Paralympic medals including eight gold medals and 24 World Major Marathon wins.

Julieanne E. Steinbacher, Esq., is a Special Needs Planning expert. Julieanne helps parents of a child with a disability with their estate plans drafting wills, special needs trusts, powers of attorneys, etc. for Pennsylvania residents. She also writes extensively in the area and leads a group of attorneys in this area.

James Lange, CPA/Attorney – I have written ten books for IRA and retirement plan owners and have been quoted in The Wall Street Journal 36 times. My last book, Retire Secure for Professors and TIAA Participants has 68 of 70 glowing 5-star reviews on Amazon. Much of that content overlaps with this book.

James Lange

CPA/Attorney/Registered Investment Advisor

Jim’s tax and estate planning strategies have been endorsed by The Wall Street Journal (36 times). He is the author of 8 best-selling books. Some of his books have been endorsed by Charles Schwab, Larry King, Jane Bryant Quinn, Roger Ibbotson, Ed Slott Bob Keebler Larry Kotlikoff, Jonathan Clements, Paul Merriman and Burton Malkiel.

James Lange

Julieanne E. Steinbacher

Esq., CELA/LLM in Estate and Elder Law

Julieanne is the founding shareholder of Steinbacher, Goodall & Yurchak, an elder care and special needs planning law firm, with offices in Williamsport, State College, Wyalusing and Wysox, PA. As a former social worker, she has a unique perspective on children with a disability. Each of her law offices has social workers on staff to help families coordinate care and benefits.

Julieanne E. Steinbacher

Deborah L. McFadden

Former United States Commissioner of Disabillities

Deborah McFadden was appointed by President George H.W. Bush as U.S. Commissioner of Disabilities and was instrumental in the writing and passage of the Americans with Disabilities Act. For years, she has been recognized as one of, if not the top expert in the country helping individuals with disabilities qualify for SSI, SSDI, and other crucial resources. She is the mother of two USA Paralympic athletes. Her daughter Hannah is ranked third in the world in rock climbing. Tatyana has won 20 Paralympic medals including eight gold medals. Tatyana is one of, if not the most honored, and recognized athletes with a disability in the world.

Deborah L. McFadden