Blog for Parents of a Child with a Disability

Defining Terms: Traditional IRAs vs Roth IRAs, and Nondeductible IRAs

General Introduction

The next three posts will summarize material from Chapter 3 in Retire Secure for Parents of a Child with a Disability (RSPCD). As always, you can refer to the book for more details and extended explanations. Click here or visit https://a.co/d/bho0HPx to get your copy today.

For many people, the primary vehicle for retirement savings will be in an employer-sponsored retirement plan such as a 401(k) plan, and I’ll discuss those plans in more depth in a later blog. But some of you may have spouses or partners whose only option for accumulating retirement assets is with an IRA. Or you may have IRA accounts funded by rollovers from retirement plans from other institutions. Or perhaps you’ve contributed enough to your employer’s retirement plan and HSA to get the full employer match, and you want to explore IRA options. Or you’ve retired, or even if you are still working, and have a side business as a self-employed speaker/writer/consultant and you want options for continuing to accumulate your savings.

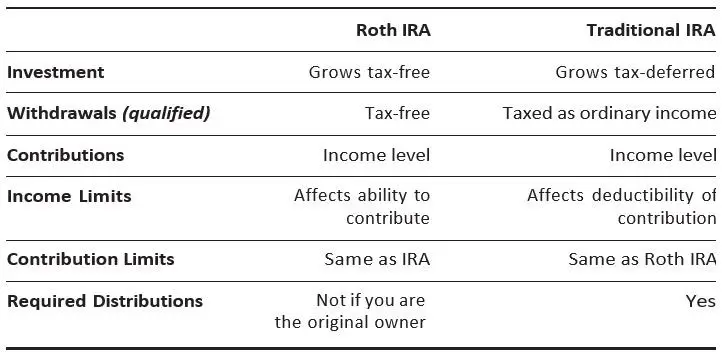

What is the Difference Between a Traditional IRA and a Roth IRA?

Note: After passing the SECURE Act, effective in the year 2020, individuals of any age can contribute to an IRA. The only requirement is the contribution cannot exceed the smaller of earned income or the IRA contribution limit.

With the exception of the Roth IRA (discussed below) and the Defined Benefit Plan, all the other retirement plans mentioned in the blogs for Chapter 2 of RSPCD can usually be rolled into an IRA, income tax-free, at retirement or service termination.

Traditional IRA

Owners of Traditional IRAs enjoy tax-deferred growth on their investment, but the contributions and earnings are taxed at the federal level when a qualified withdrawal is made. IRA owners can also take a tax deduction for their contributions if they meet either of these two requirements:

- They (and their spouse, if married) do not have a retirement plan at work.

- They earn less income than the Adjusted Gross Income (AGI) limit for deducting IRA contributions. (Subject to Traditional IRA eligibility rules which follow below.)

If IRA owners have income above the limit for which they are permitted to deduct the contribution, they may still contribute to an IRA, but without the benefit of a tax deduction. These are commonly referred to as nondeductible IRA contributions.

Roth IRA

The main characteristic of the Roth IRA is that there is no income tax deduction up front—you pay the tax on the contribution, but the investment grows tax-free and is not taxed when qualified withdrawals are made. The Roth IRA income limit on contributions is much higher than the Traditional deductible IRA income limit on contributions. This allows many higher income earners who are not eligible for a deductible IRA to participate in a Roth IRA.

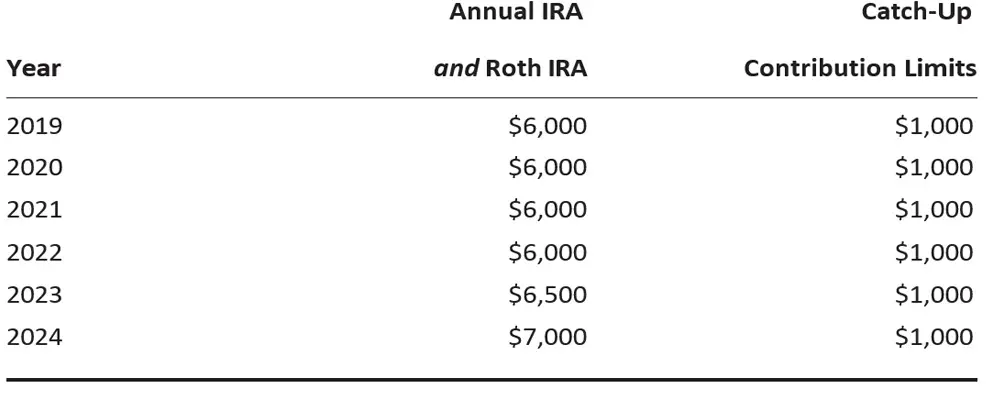

Contribution Limits for Both Roth and Traditional IRAs

The permitted contribution amounts are the same for both Roth IRAs and Traditional IRAs. Note that the total permitted contribution amount considers the combined total to both IRAs and Roth IRAs. (For current contribution limits see www.irs.gov and search for contribution limits.)

But for a broad overview of how things work, here is a table.

IRA Contribution Limits for 2019 through 2024

Contribution Limits for Individuals 50 and Older

Traditional IRA Eligibility Rules

1. All taxpayers who have earned income are allowed to contribute to a Traditional IRA without regard to income level.

2. If neither you nor your spouse participates in an employee-sponsored retirement plan, you both can deduct the full amount of your Traditional IRA contributions.

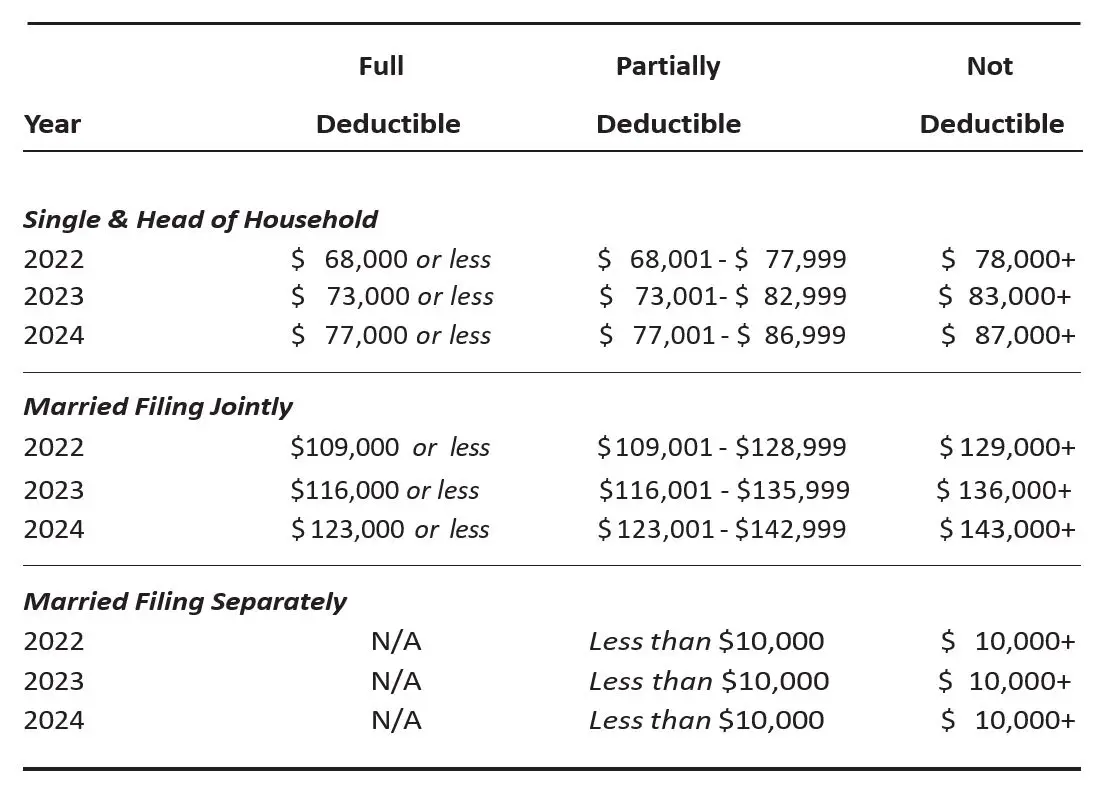

3. If you are covered by a retirement plan at work, there are AGI limits for allowing full deductions, partial deductions, and limits above which no deductions are permitted. The table below gives examples for 2022, 2023 and 2024.

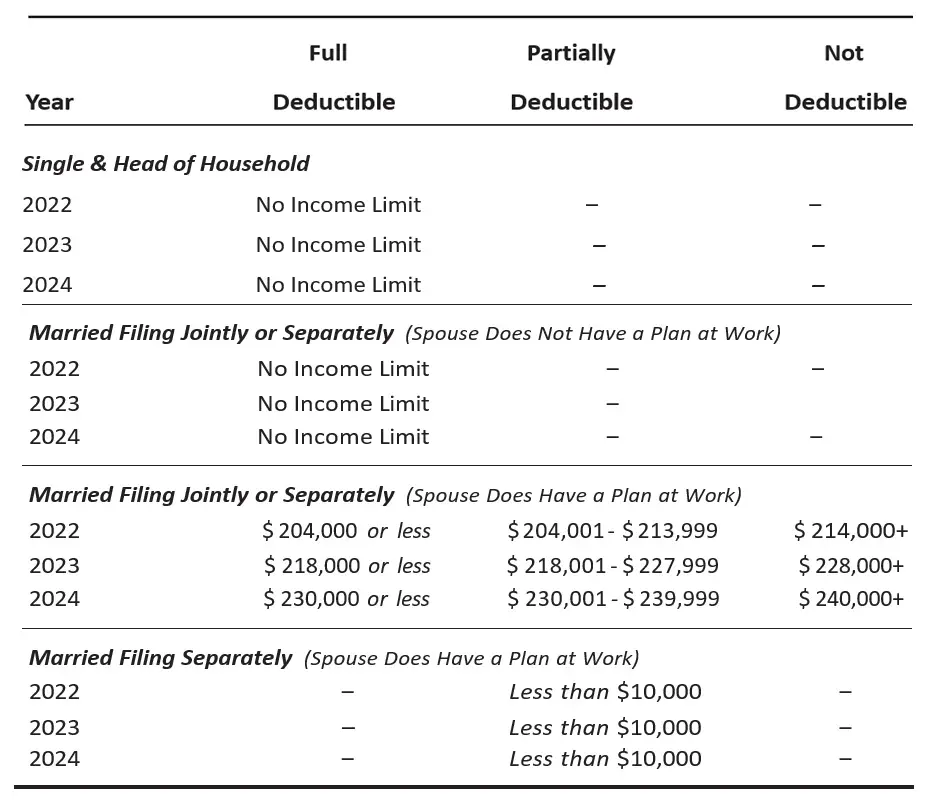

A spousal contribution can be made for a nonworking spouse if the other spouse has earned income, and a joint tax return is filed. A spousal IRA has been around for decades, but as of 2013, it has a new name: the Kay Bailey Hutchison Spousal IRA. And while the dollar amounts for contributions were increased for inflation, the basic rules for spousal IRAs are still the same. IRA contributions for both spouses are still limited by the amount of income earned by the working spouse. If the working spouse earns $8,000, then the maximum that can be contributed to both IRAs combined, is $8,000. Please note “contribution amounts” and “deduction amounts” are two different things. If the working spouse is not covered under a retirement plan at work, the non-working spouse’s IRA contribution (maximum of $7,000 or $8,000 if over age 50 – in 2024) is fully deductible. If the working spouse is covered under a retirement plan at work, the nonworking spouse can still contribute the same amount, but the tax deduction may be limited.

4. If you have too much income to deduct your Traditional IRA contribution, you can still make a nondeductible IRA contribution if you are eligible. You won’t get the income tax deduction up front, but you will still gain the advantage of the tax-deferred growth in the account.

2022, 2023, and 2024 AGI Limitations for Deducting a Traditional IRA if You are Covered by a Retirement Plan at Work

2022, 2023, and 2024 AGI Limitations for Deducting a Traditional IRA if You are NOT Covered by a Retirement Plan at Work

Roth IRA Eligibility Rules

1. As with a Traditional IRA, an individual can contribute to a Roth IRA after reaching age 70½ as long as they have earned income. Earned income includes wages, commissions, self-employment income, and other amounts received for personal services, as well as long-term disability benefits received prior to normal retirement age, taxable alimony, and separate maintenance payments received under a decree of divorce or separate maintenance.

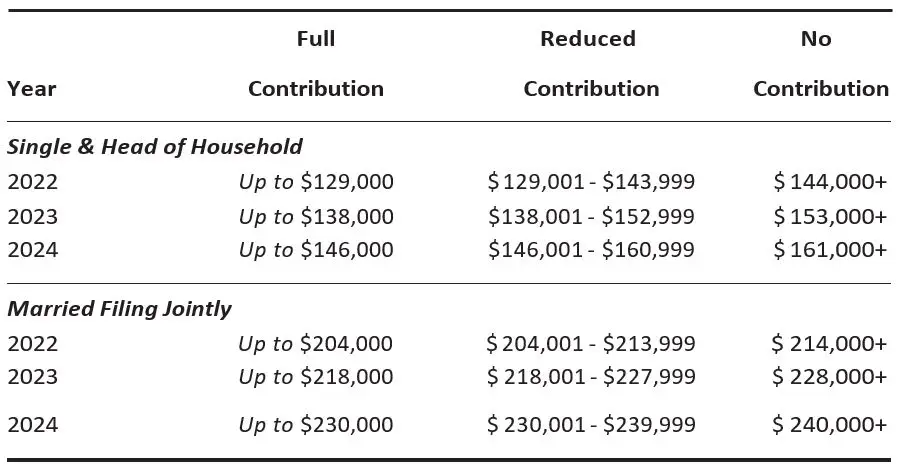

2. Individuals must meet the income tests, which exclude higher income taxpayers from contributing to Roth IRAs. (See examples below.)

3. A married individual filing a joint return may make a Roth IRA contribution for the nonworking spouse by treating their compensation as their spouse’s but must exclude any of their own IRA contributions from the income treated as their spouse’s. (For example, in 2024, if you are not yet age 50 and make $8,000, you can contribute $6,500 to your Roth, but only $1,500 to your spouse’s ) Total contributions cannot exceed your income.

2022, 2023, and 2024 Income Eligibility Rules for Roth IRAs

Nondeductible IRAs Eligibility Rules

People who have earned income, and who are ineligible to make Traditional deductible IRA contributions because their income is above the limits, can still make contributions to an IRA, but without the tax deduction. These nondeductible IRAs are also available for people who are above the income limits to make Roth IRA contributions.

If your income is below the threshold and you are eligible to make Roth IRA contributions, it is important to understand that the Roth is always a much better choice than the nondeductible IRA. Remember, you don’t get a tax deduction for either, but all the money in the Roth IRA will be tax-free when the money is withdrawn. In contrast, the growth in the nondeductible IRA will be taxable. Roth IRAs can provide a much better result over the long term. Many people make the mistake of contributing to a nondeductible IRA instead of a Roth IRA when they have a choice. Although the mistake can be mitigated if caught in time, this mistake results in future taxes that could have been avoided.

Nondeductible IRA contributions that provide tax-deferred growth, however, are still of great benefit for many high-income people who do not qualify for Roth IRA and deductible IRA contributions. Better yet, as of this writing, high income individuals are still eligible to convert their nondeductible IRA accounts into Roth IRAs with little or no tax cost. A recent IRS ruling also permits individuals who have both deductible and non-deductible contributions in their retirement plans, to split the plan assets. This means that the pre-tax portion of the plan can now be rolled into a Traditional IRA, and the after-tax portion can be rolled into a Roth IRA—effectively allowing a tax-free Roth IRA conversion. (See Chapters 16 and 17 in RSPCD for more information on Roth conversions.)

Conclusion

This post should help to clarify some of the basics pertaining to the types of IRAs and their contribution limits.

In the next blog I will cover the distribution rules for Traditional IRAs and Roth IRAs.

If any particular topic catches your attention, remember a full discussion is available in our book Retire Secure for Parents of a Child with a Disability, click here or visit https://a.co/d/bho0HPx to get your copy today.